Innovative approach to investment

Scroll down for more

Financial markets are very complex systems which are influenced by many factors. Nowadays trading approach is to deal with these factors trying to figure out when and how they influence the asset price. Once you of course accept the fact that markets are complex system as any other systems then you are on a brink of great discovery.

Why do individuals pay much higher prices for some stocks versus other stocks? The common reply to this is the law of supply and demand. What is behind this law? To provide an answer to this question economists refer to the law of diminishing marginal utility.

In order to measure supply and demand or at least to create an applicable model we must set right the process of human action behind the valuation process.

Human action is not directed by biological needs but by reason. As described Ludwig von Mises:

It is impossible to describe any human action if one does not refer to the meaning the actor sees in the stimulus as well as in the end his response is aiming at.1

In this sense valuations done by individual are in accordance with the facts of reality. Individuals are valuing available means at their disposal against the goals that will enable them to maintain their life and wellbeing.

Price action represents constant change in valuations done by individuals. Even though facts of reality are the same for all individuals their goals and means at their disposal vary greatly.

Therefore price of any asset can trend only when there is a line up of enough individual goals aiming for the same direction. In order to uncover whether there is enough “force” to change or maintain the current price direction we can use Thermodynamics theory of Phylogenetic Development.

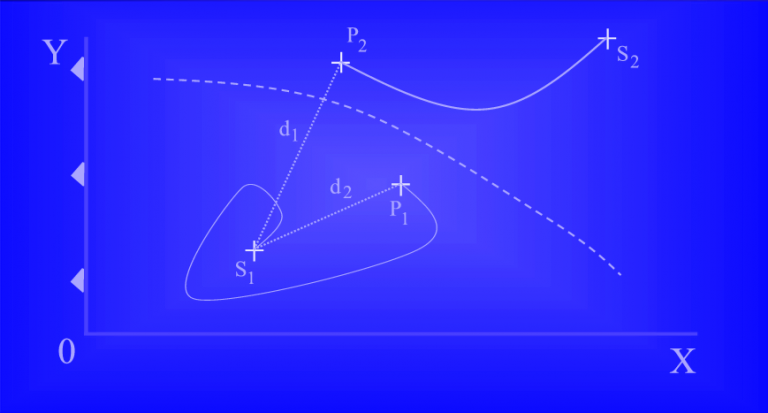

Phylogenetic development describes transition from stationary disordered state to new stationary orderly state by fluctuation.

In case of a small fluctuation d1 the system returns from P1 back to S1. If fluctuation d2 is large enough to penetrate the border of stability then the system goes from P2 to new stationary state S2 as a next step in its phylogenetic development.

FX Rich Management developed model which not only specify the border of stability, it also measure the fluctuation. In other words it helps us determine when and where the trend is going to change.

1 – Ludwig Von Mises The Ultimate Foundation of Economic Science. Chapter 2 Mises Institute website.